The credit report is a critical element of financial life because it determines whether or not you could get credit, how positive or negative the conditions are, as well as what it costs to finance. Discover how to obtain a free credit report as well as how this is a smart option.

Every other 12 months, individuals are eligible for a free credit report in each of the 3 main consumer credit reporting businesses such as Equifax, Experian, and TransUnion. AnnualCreditReport.com can provide you with a copy of your credit report if you want it.

What Exactly is a Credit Report?

A credit report is a synopsis of your credit record. The credit report contains your identifiable details, such as your location and birth date, as well as details about your credit record, such as how users pay their bills and whether or not users have declared bankruptcy. The above information is collected and updated by the three largest credit bureaus namely Equifax, Experian, and TransUnion. Often these national superstore and bank credit card records, as well as borrowings, are shown in your file, although not all debt collectors report information to credit bureaus.

This same data in your credit report might have an impact on your purchasing power. It could also affect your ability to find work, rent or buy a home, and obtain financial protection. Consumer credit bureaus release the data in your record to companies, who use it to determine whether to lend you money, extend credit to you, provide you coverage, or lease you a house. Credit reports are used by certain organizations in employment decisions. The amount you would have to spend to take loans is also affected by the quality of your credit history.

Credit reporting agencies must:

- Ensure that all information they gather on you is genuine;

- Provide you with a free copy of the report once every 12 months

- Allow you to correct any errors

This is required under the Fair Credit Reporting Act (FCRA), a federal statute.

What is the Point of Getting a Copy of my Report?

Obtaining your credit history can assist you in protecting your credit record from inaccuracies, errors, or indications of identity theft.

Check to ensure that data is correct, thorough, and up to date. Take into account practicing this once a year at the very least. Verify before applying for finance, a loan, protection, or a job. If you discover errors in your credit history, contact the credit bureaus and the company that provided the information to have the errors erased from your report.

Check to aid in the detection of identity fraud. Inaccuracies on your credit history might be a symptom of identity theft. After identity thieves have obtained your private information, identity theft can harm your credit by causing unpaid invoices and previous-due accounts. If you suspect someone is exploiting your private information, go over to IdentityTheft.gov to notify it and receive a tailored recovery plan.

Credit reports assist lenders in determining whether to provide credit or authorize a debt to you. The assessments also aid in determining the rate of interest that will be charged to you. Businesses, insurers, and landlords may also check your credit record. Users can’t determine which credit report will be used to examine their credit by a creditor or employer.

CRAs commonly known as Credit reporting companies gather and store data for your credit history. Each CRA has its own data and may not have details on all of your accounts. Despite discrepancies in their findings, no agency is more essential than the others. As well as the data that each agency possesses must be correct.

Getting a Credit Report on Website Step by Step

We’ll show you when to use the website and what to look for while examining your credit reports.

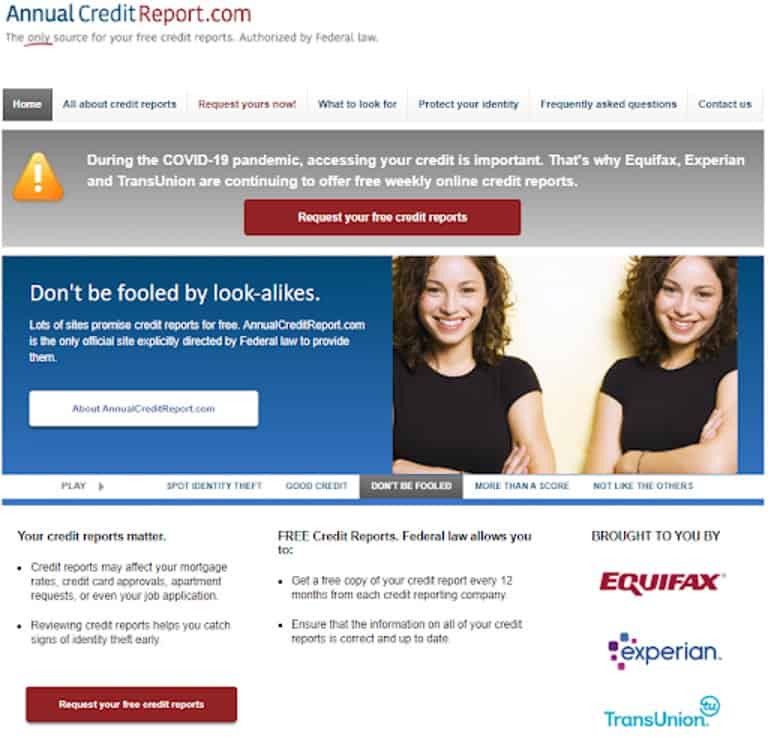

1. Navigate to AnnualCreditReport.com

To begin, go to AnnualCreditReport.com and request your credit reports. To avoid attacks to obtain your private information, make sure you visit the proper website by entering the URL to your internet browser’s search bar or following a hyperlink from a website you know. This is how it appears:

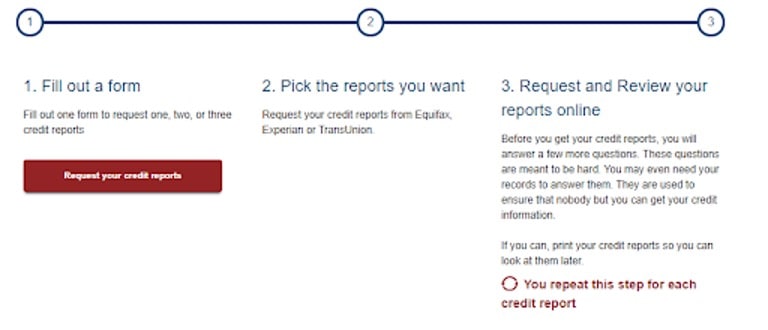

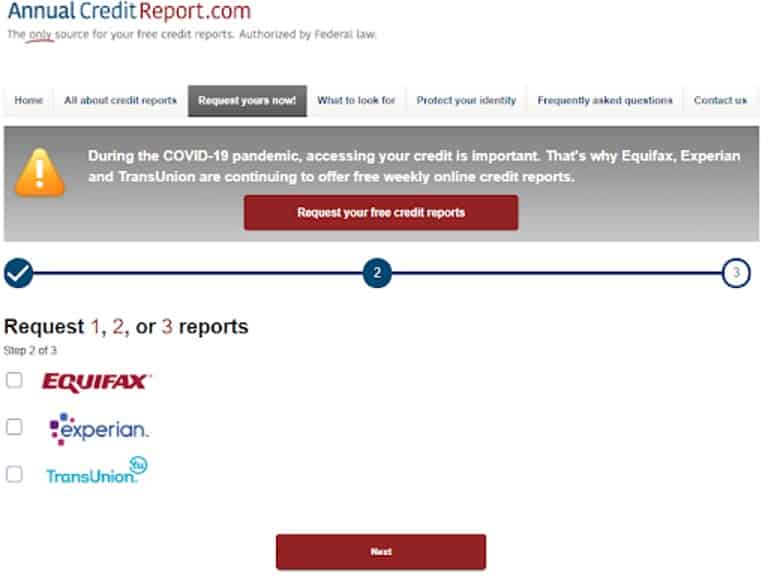

2. Fill Out Your Personal Information

Once you’ve arrived at the relevant website, hit the “Request your free credit reports” option towards the top or bottom left of the screen. Then, underneath the line that says “Fill out a form,” tap on the option with much the same wording. Next, put your name, birthday, full address, and SSN into the form which would be your Social Security Number.

If you have not resided at your present location for a minimum of 2 years, you must also give your prior address.

3. Obtain credit reports and respond to any security questions

After completing the form, you will be able to get credit reports from 3 major credit agencies. To authenticate your identity, you will most likely be required to respond few security questions. For instance, individuals may be questioned about when they were born or about other services they may have held. You may also be asked to submit your contact information in order to obtain an OTP.

4. Online Report Generation

Once you’ve accessed your credit reports, save copies to your desktop or print them before closing the window for subsequent perusal.

If you are having difficulty receiving an electronic version of your credit reports, you may also get a copy by email or by phone. Complete out the postal request process and give that to this address to obtain a free copy via mail:

- P.O. Box 105281 Atlanta, GA 303348-5281 Annual Credit Report Request Service

- The inquiries on the form are the same as those on the application portal.

- If you’d rather call, phone 877-322-8228

5. Review and Dispute Credit Report

Reading your credit report is one of the most important stages of establishing and keeping credit. While examining your report, ensure that your personal and account information is correct.

The following are examples of common credit reporting problems to check for:

- Invalid name or address

- Account balance as well as credit limit inaccuracies

- Paid accounts that seem to be reported as open

- Accounts that really don’t pertain to you

If you find a mistake, you should appeal this with every credit bureau that displays everything on your report as well as the lender that reported it. The inquiry will normally take 1 month to conclude. When it’s finished, the credit bureau may erase the material if it discovers that it was a mistake.

You have the option of ordering all three reports altogether or one at a time. You may check your credit report all year by getting the reports individually (for example, once every four months). You may still obtain more reports when you’ve already gotten your yearly free credit report. A credit reporting business is not permitted by law to charge upwards of $13.50 for just a credit report.

You may also be qualified for reports from specialized consumer credit reporting firms. We’ve compiled a list of some of these firms so you can discover which ones are relevant to you. You must obtain the reports from all of these firms separately. Many of the firms on this list will deliver a report for free on a regular basis. Other businesses could charge you a fee for your report.

Whether any of the following is true to you, you can obtain further complimentary reports:

If you got word that you were refused credit, policy, or job depending on a credit report, they have the right to have access report out from the consumer credit firm named in the letter. To obtain the free report, customers must demand it within sixty days after receiving the notice. Other forms of “adverse action” letters you may obtain include notice of an unfavorable adjustment in the terms or quantity of existing debt or insurance coverage, as well as notice of an unfavorable change in the conditions of your job, a license, or other official benefits.

- You suspect that your file is erroneous as a result of fraud.

- In accordance with the placement of an early fraud alert, you obtained a credit report from a national consumer credit firm. you are allowed to request two free copies for an extended fraud alert.

- You are jobless and want to apply for work within 60 days after submitting your application.

- You are a receiver of government aid.

- Your state legislation entitles you to a free copy.

Be wary of services that claim to provide free credit reports. A few of these websites can only provide you with a free credit report if you purchase additional items or services. Many websites provide a free report and afterward cost you for services that you must cancel.

If your application for a free consumer credit report is declined, you should contact the CRA immediately to attempt to answer the problem. The CRA must clarify why they declined your application and what you’d do next. Usually, customers will simply need to share details that were lacking or erroneous on the free credit report application.

If you are unable to settle your disagreement with the CRA, you should contact the Consumer Financial Protection Bureau roughly known as CFPB.

What to Predict When Obtaining a Credit Report

What information do I need to provide?

The credit bureaus have a method in place to verify your identification in able to preserve your profile and information protected. Prepare to provide your name, location, Ssn, and birth date. Whether you have moved within the last two years, you may be required to provide your old address. They’ll ask you some personal inquiries, such as the sum of your mortgage payment. You may explain how it works for each credit agency, even if you request credit reports from all three at the very same time. Each credit agency may request conflicting information from you since the material on your file may have originated from various sources.

When will my report be delivered?

You can get it immediately away or within 15 days, depending on how you got it.

- Electronically at AnnualCreditReport.com, you’ll receive instant access by dialing toll-free at 1-877-322-8228, it’ll be reviewed and delivered to you in the next 15 days

- Via mail using the free Annual Credit Report Request Form, it’ll be prepared and sent to you in the next 15 days from the date of your request

- If the credit agency requires more documentation to verify your identification, this could take longer to receive your report.

Is it Possible to Acquire My Report in Braille, Big print, or Audio Format?

Yes, you can get your free yearly credit report in Braille, big print, or audible version. It usually takes 3 weeks to receive your credit information reports in these forms. Whether you are deaf or struggle to hear, you can use the TDD service at AnnualCreditReport.com by dialing 7-1-1 and referring the Relay Operator to 1-800-821-7232. If you are blind or visually challenged, you can request free yearly credit information in Braille, big print, or voice format.

How to Keep an Eye on Your Credit Report

Shall I get credit reports across all three credit agencies at once?

You may obtain free reports all at once or spread them out over the course of the year. Truly astonishing your requests across a 12-month period, according to some financial consultants, maybe a smart method to handle an eye on the quality and credibility of the data in your reports. Since each credit bureau obtains its information from multiple sources, the material in one credit bureau’s report might not even represent all or even the same, material in another two credit agencies’ reports.

Is it possible for me to purchase a copy of my credit reporting?

Yes, if you are not eligible for free credit history, a credit agency may cost you a fair fee for a duplicate of your review. But, already when you buy, consider whether you can acquire a free copy at AnnualCreditReport.com.

Who Has Access to Your Annual Credit Report?

One that could get your credit check is governed by federal law. If you submit the application for a personal loan, credit card, insurance, a vehicle lease, or an accommodation, those companies can request a copy of your credit report, which aids in credit choices. A current or potential employer may obtain a free credit report provided you consent in writing.

Other Websites That Provide Credit Reports Should Be Avoided

You may come across firms and websites that promise free credit reports, but there is only one approved location where you may obtain the free yearly credit report required by law: AnnualCreditReport.com. These domains promise to be affiliated with AnnualCreditReport.com or to provide free credit reports, credit ratings, or monitoring services. They also use phrases like “free report” in their titles. They might also have Sites that misspell AnnualCreditReport.com, deliberately, in the expectation that you would input the official site’s name incorrectly. If users visit these kinds of impostor sites, users may be directed to other websites that would like to sell customers something or gather — and subsequently sell or exploit such as your personal details.

AnnualCreditReport.com and the credit bureaus would not send you an email requesting your Social Security Number or banking information. If you receive an email, see a catchy ad, or receive a telephone from someone purporting to have been from AnnualCreditReport.com or some of the other credit agencies, do not respond or engage on any links in the text. It’s most likely a ruse.

Scams Should be Reported

Inform the FTC if you witness a scam, deception, or unethical business activities. Go to ReportFraud.ftc.gov, the FTC’s website that makes it simple to submit fraud.

Credit Scores

A credit rating is a statistic that indicates how risky your credit is. It can assist lenders in deciding whether to lend you credit, the conditions they offer and the cost of borrowing you pay. A good score can help you in a variety of ways. It may simplify things for you to qualify for a loan, rent a house, or reduce your insurance premium.

Credit bureaus use data from your credit history to compute your credit rating. Your score is affected by the following information:

- History of payments

- Accounts receivable

- Credit history length

- Expanded customer credit applications

- Customer’s credit types of accounts notably housing loans, car loans, credit cards, etc.

Making sure your credit report is up to date assures that your credit score is as well. You can have more than one credit score. These scores are not computed by the credit reporting organizations that keep your credit reports. Instead, they are developed by several firms or lenders that have their own credit rating algorithms.

Your credit score is not included in your free yearly credit report, but you may obtain it from a variety of places. It’s possible that your credit card provider will offer it to you all for free. You may also get it in one of the 3 primary credit bureaus. Once you obtain your score, you usually get recommendations for enhancing it.

Credit Freezing

You can limit access to the accounting report by imposing a credit freeze. This is critical following a security breach or impersonation if someone might use your private information to open new credit lines. While creating a new account, many creditors check your credit report. However, if you have blocked your credit record, mortgage lenders cannot check it and are unlikely to approve bogus applications.

Everyone gets the authority to form or remove a credit freeze at no cost. You may set a credit freeze upon your personal credit reports including those of your children aged 16 and under.

Set a Freeze

To request freezing on your credit record, email every credit reporting organization. Every agency takes freeze applications online and over the phone.

If you put a credit crunch online or by telephone, it will take full effect the 1 business day. If you put the freeze via email, it will come into operation in 3 business days just after the credit bureau accepts your application. A credit freeze never expires. Until and unless users remove the credit freeze, everything just remains in effect.

Remove a Freeze

Unless you want creditors and other firms to be able to obtain personal credit files freely, you must either indefinitely or partially release your credit freeze. Initiate contact with every credit bureau. To unfreeze your credit, you’ll need to enter a Passcode. You may remove the credit freeze as many times as you need to without incurring any penalty.

When you submit a lift order online or over the phone, it requires approximately one hour for it to be processed. Whenever you demand the lift by email, it may take up to three working days.

Report Inaccuracies

If you discover a mistake on your credit report, send a letter contesting the inaccuracy and provide any relevant proof. Then, forward it to:

- The consumer credit organization include Experian, Equifax, and TransUnion.

- The data provider provided the credit reporting agency with false information.

- Financial institutions firms are examples of these service providers.

Download an example dispute letter and full procedures for reporting problems.

Your credit report must be corrected by the CRA also known as, the credit reporting agency and the data supplier. This covers any errors or missing data. The Fair Credit Reporting Act imposes the need to correct any mistakes.

Whenever your complaint filed does not result in the correction of the problem, you may register a claim with the CFPB that is known as the Consumer Financial Protection Bureau.

Negative Information on the Report

Negative information in a credit report might include public records such as tax liens, judgments, and bankruptcies, all of which give insight into your financial situation and responsibilities. Most negative information can be reported by a credit reporting firm for seven years.

Information regarding litigation or a judgment versus you may be published for 7 years or when the limitation period expires, whichever comes first. Job losses can be held on your record for up to ten years, while nonpayment of taxes liens can be maintained for up to fifteen years.

Correcting Report Errors

That everyone who refuses you credit, accommodation, insurance, or employment because of a credit report is required to furnish you with the name, location, and contact information of the credit reporting agency or we say, CRA that produced the report.

If a firm rejects your credit while investigating the report, individuals have the right underneath the FCRA to seek a free credit report within 2 months.

If the credit report includes wrong or missing information, you can get it corrected:

- Call both the credit agency and the firm that supplied the CRA with the data.

- Notify the CRA in detail of any data you feel is incorrect. Maintain a copy of every communication.

- Some firms may claim to repair or mend your credit for a charge up the advance, and there’s no way to erase true bad information from your credit report.

Submit a Complaint

If you’ve had a concern with credit reporting, users can submit a claim with the Consumer Financial Protection Bureau.

Medical History Report

The medical history statement is a synopsis of personal medical history. These evaluations are used by insurers to determine whether or not to provide customers insurance. MIB, the firm that operates and controls the reporting database, has the right to provide you with a duplicate of your report.

Information Sources for the Report

If you disclosed a medical issue on an approval request, the insurance company may wish to notify MIB. Just with your explicit consent, an insurer is allowed to communicate your health condition with MIB. If you decide to provide authorization, the diagnosis will be documented in your medical history record.

One’s medical history document does not contain all of their medical records. MIB does not accept information from doctors, institutions, pharmacies, or other health providers. The report will not include every diagnostic, blood sample, or medication list.

A piece of data remains on the record for 7 years. Just when you enroll for an insurance plan with a MIB-member firm and grant them the opportunity to bring your medical problems to MIB, so that this report can be revised by them.